This chapter contains the following topics:

QTD/YTD Time Worked Report (by State)

QTD/YTD Time Worked Report (by City)

Employee Deductions/Earnings Report

Use the Employee/Employer Reports selection to print the Check Register History Report, Union Deductions Report, QTD/YTD Time Worked Report (by State or City), Workers’ Compensation Report, 401(K) Contributions Report, Employee Deductions/Earnings Report, Meals Expense Report and Form 941, Employer’s Quarterly Federal Tax Return Form.

This report will print a register of employee checks by employee number.

You may limit the report by cash account, date range, employee number range and check number range.

Pay information included on this report is the employee’s number and name, the check type, check date, pay period date, the check gross, total tax amount taken from the check, total amount of deductions taken from the check, the employee’s net pay and tips/meals amount.

A subtotal is printed for each employee showing total gross pay, total taxes, total deductions, and total tips/meals amount.

When you are using the direct deposit electronic payment method it prints a transaction number and direct deposit transactions are indicated by a "T" next to the transaction number. A payment to an employee can be split between a check and a direct deposit transaction. Split pay are indicated with an "*" next to the check number. There is no transaction number for a split payment.

Grand totals are printed for the range of checks printed on the report.

See a Payroll Register History report example in the Form and Report Examples appendix.

Select

Check register history from the Reports, Employee/Employer menu.

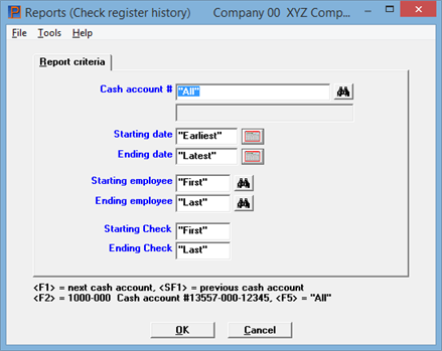

Graphical Mode

A screen similar to this will be displayed:

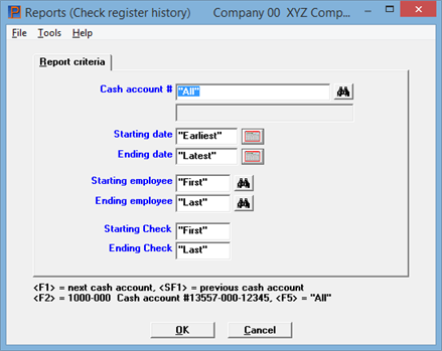

Character Mode

A screen similar to this will be displayed:

Enter the following information.

Options

Enter the cash account you wish to print this report for or use one of the options.

|

<F1> |

To scroll forward through the cash accounts |

|

<SF1> |

To scroll backward through the cash accounts |

|

<F2> |

To list the default cash account specified in Control information |

|

<F5> |

To include checks for all cash accounts |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Press <F2> for the default cash account |

Enter the starting check date for the range of checks you wish to include in this report or use the option.

|

<F2> |

For Earliest |

|

Format |

MMDDYY |

|

Example |

Press <F2> for the Earliest check date you wish to print |

Enter the ending check date for the range of checks you wish to include in this report or use one of the options.

|

<F2> |

For Latest |

|

<Enter> |

For the same date as the starting date |

|

Format |

MMDDYY |

|

Example |

Press <F2> for the Latest check date you wish to print |

Enter the employee number of the first employee you wish to print on this report or use the option.

|

<F2> |

For first employee |

|

Format |

999999 |

|

Example |

Press <F2> for the First employee |

Enter the number of the last employee you wish to print on this report or use one of the options.

|

<F2> |

For last employee |

|

<Enter> |

For the same employee number as the starting employee |

|

Format |

999999 |

|

Example |

Press <F2> for the Last employee |

Enter the check number of the first check or direct deposit transaction number you wish to print on this report or use the option:

|

<F2> |

For first check or direct deposit transaction number |

|

Format |

999999 |

|

Example |

Press <F2> for the First check |

Enter the number of the last check or direct deposit transaction number you wish to print on this report or use one of the options.

|

<F2> |

For last check or direct deposit transaction number |

|

<Enter> |

For the same check number as the starting check |

|

Format |

999999 |

|

Example |

Press <F2> for the Last check |

Make any desired changes. Select OK to print the report.

Using character mode press <Enter> to print the report.

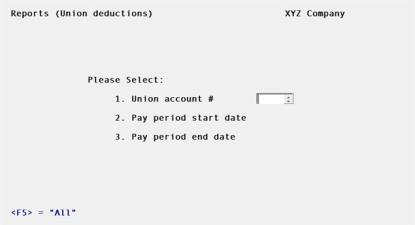

This report shows union deductions by employee for a selected union deduction account number (or all union deduction account numbers), and for a selected pay period (or all pay periods). The report can be used internally by payroll personnel and can also be submitted to the unions, along with remittance of the amount deducted.

Note that this report uses information in Payroll History. Information for certain periods is no longer available if Payroll History is purged for those periods.

The Union Deductions Report includes the employee’s social security number, employee name, hours worked (regular, overtime, and special), subject pay (pay subject to union deductions), the method used to calculate the union deduction (per hour deduction, percentage of gross pay, or fixed amount per pay period), and the amount of union deduction per employee. Union totals are printed on the report.

Only the last 4 digits print of the social security number print on the report. The first five digits are replaced with asterisks.

Select

Union deductions from the Reports, Employee/Employer menu.

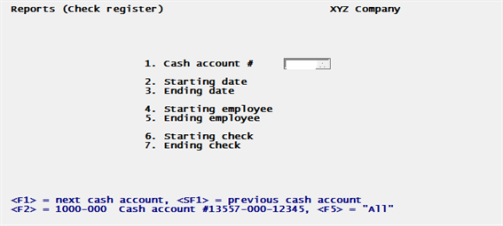

Graphical Mode

Character Mode

Enter the following information:

Union account merely means one of the accounts entered in the Union deduction field of Employees.

Options

Enter the number of the account for which the Union Deductions report is produced, or use the option:

|

<F5> |

For All union accounts |

The description of the union account is displayed after you enter the account number.

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Press <F5> |

Options

Enter the starting date of the first pay period for which the Union Deductions report is to be produced, or use the option:

|

<F2> |

For Earliest |

|

Format |

MMDDYY |

|

Example |

Type 30115 |

Options

Enter the ending date of the last pay period for which the Union Deductions Report is produced, or use the option:

|

<F2> |

For Latest |

|

Format |

MMDDYY |

|

Example |

Type 31415 |

Make any needed changes. Select OK or press <Enter> to print the report.

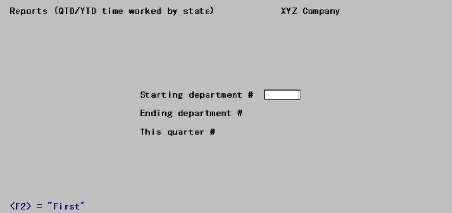

This report shows the hours and pay for each employee, with quarter-to-date and year-to-date totals. Each type of hours (regular, overtime, special, sick, vacation, and holiday) and of pay (vacation, holiday, and sick) is shown separately. There is a separate entry for each employee, in sequence by employee number within department, with totals and averages for each department.

State is shown for each employee. This is the first two characters of the employee’s state tax code. Multi-state information if any is not shown, nor are there any totals by state.

Select

QTD/YTD time worked (by state) from the Reports, General menu.

The following screen displays:

Graphical Mode

Character Mode

Enter the following information:

Ending department #

Options

Enter the range of department numbers to include in the QTD / YTD Time Worked Report, or use the option:

|

<F2> |

"First" starting department or "Last" ending department number |

|

Format |

9999 at each field |

|

Example |

Press <F2> |

Enter the number of the quarter which the report is to be printed.

|

Format |

One digit from 1 through 4 |

|

Example |

Type 1 |

Select OK to print the report or Cancel to return to the menu without printing.

Character Mode

Any change?

Answer Y to re-enter the screen, or N to print the report.

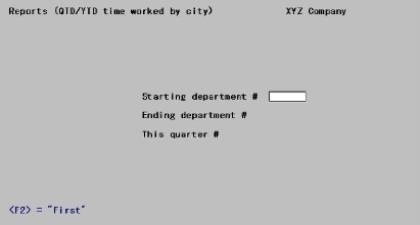

This report is identical to the preceding except that the city (the first two characters of the employee’s city tax code) is shown for each employee in addition to the state.

Select

QTD/YTD time worked (by city) from the Reports, General menu.

The following screen displays:

Graphical Mode

Character Mode

Enter the following information:

Ending department #

Options

Enter the range of department numbers to include, or use the option:

|

<F2> |

"First" starting department or "Last" ending department number |

|

Format |

9999 at each field |

|

Example |

Press <F2> |

Enter the number of the quarter for which the report is to print.

|

Format |

One digit from 1 through 4 |

|

Example |

Type 1 |

Select OK to print the report or Cancel to return to the menu without printing.

Character Mode

Any change?

Answer Y to re-enter the screen, or N to print the report.

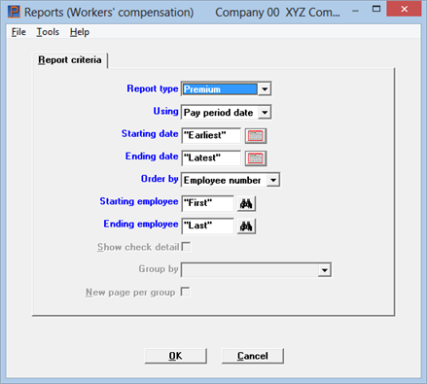

Use this selection to print either of the three Workers' Compensation report types; Premium, Pay or History.

All three types can be printed by either a range of pay period dates or check dates. They can also be printed by a range of employees using either employee number or employee name. Here are some of the differences:

Premium

| • | The Premium type shows the estimated workers’ compensation premiums. The report is printed by workers’ compensation code so that estimated premiums for one type of work are shown together. For security purposes only the last 4 digits print of the social security number print on the report. The first five digits are replaced with asterisks. |

Pay

| • | The Pay type shows employee hours, pay, overtime hours, overtime base and overtime premium and special pay by quarter. It can be printed with or without check detail. It can be grouped by workers' compensation code or department. When entering specific dates it is restricted to a maximum of three years of data. The totals are grouped by quarter with a grand total for each year. |

When printing the Pay type report and when grouping by Workers' compensation code, in order for the employee's workers' compensation data to print, the Work Comp class field in Employee's (Enter) must have a value at the time the payment is calculated.

For both reports:

| • | Overtime pay hours are reported using the Regular rate. |

| • | Special pay uses the special pay rate to determine the Workers' comp pay. |

| • | As a supplemental earning does not have a rate, when both regular hours and supplemental pay are on the same check, the average rate is calculated and added to the Regular rate. If only supplemental pay is on the check, no rate is reported. The premium is based on the Workman's comp gross. |

| • | The Payroll history by WC code report combines data from Payroll time worked history and adjustment history. |

Earlier in 2020 an e-mail was sent by Passport recommending that Workers' Compensation codes of COL for Family Leave and COS for Sick Leave, entered as special pay, to be used for accumulating COVID-19 amounts. This report is intended on providing the amounts. The data is recorded in history and will print on this report.

If you have not done this and you have amounts to report, you must use a manual method to determine the amounts for 941 reporting.

Whether you used the Workers' Comp codes or you are using a manual method of tracking the Family Leave and Sick Leave amounts, enter the amounts on the 941 Prep. Report screen.

You should print this report using a date range for a quarter of the year being reported. Use the check date range.

For field by field instructions, see the Payroll History by WC Code Report below.

Select

Workers’ compensation from the Reports, Employee/Employer menu.

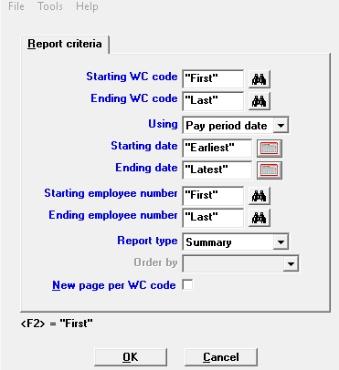

Graphical Mode

The premium report options display:

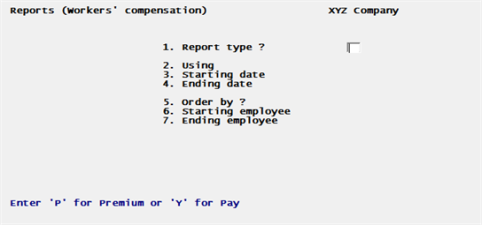

Character Mode

The following screen displays:

Enter the following information:

You must select a type:

| Character | Graphical | Description |

|---|---|---|

| P | Premium | Print the premium report |

| Y | Pay | Print the pay report |

See Workers’ Compensation Reports for an explanation of both types.

The default is Premium in graphical mode.

You may print the report by these date ranges:

| Character | Graphical | Description |

|---|---|---|

| C | Check date | Print by check date |

| P | Pay period date | Print by pay period date |

Ending date

The range of dates is based on whether you selected Check date or Pay period date in the previous field.

Options

Enter the date range of the dates for which the Workers’ Compensation Report is to print, or use the option:

|

<F2> |

Premium report: For "Earliest" starting date or "Latest" ending date Pay report: For "Earliest" starting date or for an ending date three years after the starting date |

|

Format |

MMDDYY at each field |

|

Example |

Press <F2> at each field |

You may print in order by the following:

| Character | Graphical | Description |

|---|---|---|

| N | Employee number | Print by employee number |

| A | Employee name | Print by employee name |

Using graphical mode the default is by employee number.

The following fields is are only available when printing the Pay report type.

Starting employee and Ending employee

Enter the range of employees that you want to include on the report. You may use the option:

|

<F2> |

For "First" starting employee or "Last" ending employee |

Check this box or enter Y to see worker's compensation for each check within the date range, by the date type (Pay period or Check) and by employee range. Leave it unchecked to see workers' compensation within the date range, by date type and employee range summarized by employee.

The default for graphical mode is unchecked and for character mode it is N.

You may group the pay report by the following:

| Character | Graphical | Description |

|---|---|---|

| W | Workers' compensation code | Group by workers' compensation code |

| D | Department | Group by department |

Using graphical mode the default is by Workers' compensation code.

Check this box to start a new print page for each workers' compensation code or department, depending on what you selected in the Group by field. The pay report totals are printed by themselves on the last page.

Leave it unchecked to start each group immediately after printing the previous group. The totals start printing immediately after the last group.

Using character mode enter Y for a new page per group and N for not starting a new page per group.

Make any desired changes and then select either OK or press <Enter> to print the report. Select Cancel or press Esc to return to the menu without printing.

See History above for information on this report.

941 Reporting

If you are using this report for COVID-19 data intended for the Form 941, use the Social security gross from the COL totals and COS totals. These amounts are entered on the 941 Prep. report 5a (ii) Qualified family leave wages from the COL totals and the 5a (i) Qualified sick leave wages from the COS totals.

If reporting the 941 field 24 for wages paid March 13, 2020 through March 31 2020, run the report by that date range and use the Social security amount from the Report totals.

After selecting History (H) for the report type, this screen displays:

Enter the starting and ending Workers' Compensation code or use the option:

|

<F2> |

For "First" starting WC code or "Last" ending WC code |

|

Format |

Up to three characters for each field |

|

Example |

Type COL for the starting code and COS for the ending code. |

Enter Pay period date or Check date. If using this report for COVID-19 reporting, select check date.

| Character | Graphical | Description |

|---|---|---|

|

C |

Check date |

Report by check date. A check date range is recommended for COVID-19 reporting amounts. |

|

P |

Pay period date |

Report by pay period date |

|

Example |

Select Check date. |

Enter the starting and ending date.

If using this report for COVID-19 reporting, enter the starting date for start of the quarter and for the ending date, enter the end of the quarter. You may also use the option:

|

<F2> |

For "Earliest" starting date or "Latest" ending date |

|

Example |

Enter the begining of the quarter for the Starting date and the end of the quarter for the End date. |

Starting employee and Ending employee

Enter the range of employees that you want to include on the report. You may use the option:

|

<F2> |

For "First" starting employee or "Last" ending employee |

|

Format |

By number: 6 digits By name: 70 characters |

Enter either Detailed or Summary. The detailed report includes check information.

| Character | Graphical | Description |

|---|---|---|

|

D |

Detailed |

For a report that includes check details |

|

(blank) |

Summary |

For a summary report for totals only |

This field is only available if you selected a detailed report.

Enter in order by employee number or employee name.

| Character | Graphical | Description |

|---|---|---|

|

N |

Employee number |

To print the details in employee number order. |

|

A |

Employee name |

To print the details in employee name order. |

Check this box if you want each Workers' Compensation code to start printing on a new page.

Make any desired changes and then select either OK or press <Enter> to print the report. Select Cancel or press Esc to return to the menu without printing.

This report shows employee regular, Roth and employer contributions to 401(k) plans.

For security purposes only the last 4 digits print of the social security number print on the report. The first five digits are replaced with asterisks.

See a 401(k) Contributions report example, without check detail, in the Form and Report Examples appendix.

Select

401(k) contributions from the Reports, Employee/Employer menu.

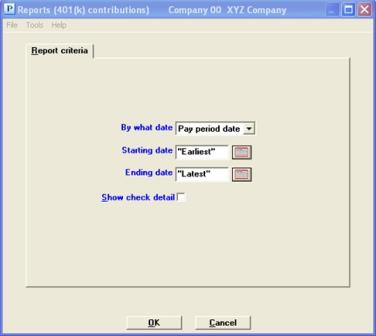

Graphical Mode

The following screen displays:

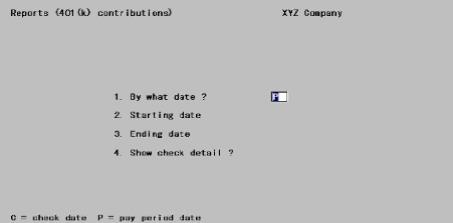

Character Mode

The following screen displays:

Enter the following information:

You can have the report print in either Pay period date (P) order or Check date (C) order. The starting and ending dates that you enter below refer to the type of date you choose here.

|

Format |

Graphical: Drop down list, either Pay period date or Check date. The default is Pay period date Character: One letter, either P or C. The default is P. |

|

Example |

Press <Enter> |

Ending date

Options

Enter the date range for which the 401(k) Contributions Report is to print, or use the option:

|

<F2> |

For Earliest starting date or Latest ending date |

|

Format |

MMDDYY at each field |

|

Example |

Type 30115 as the starting date and 33115 as the ending date |

Answer Y to see 401(k) contributions for each check within the date range and by the date type (Pay period or Check). Answer N to see 401(k) contributions within the date range and by date type summarized by employee.

|

Format |

Graphical: Checked is yes and unchecked is no. The default is unchecked Character: One letter, either Y or N. The default is N. |

|

Example |

Press <Enter> |

Make any desired changes and then select OK or press <Enter> to print the report.

This report shows total employee deductions and earnings for a specified pay period.

This report does not include deduction amounts for 401(k) and union.

Select

Deductions/Earnings, Employee from the Reports, Employee/Employer menu.

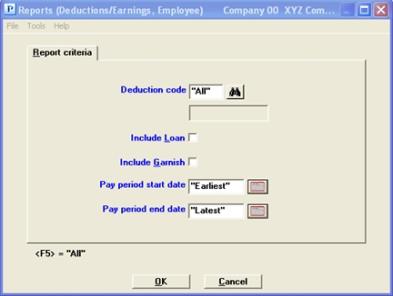

Graphical Mode

The following screen displays:

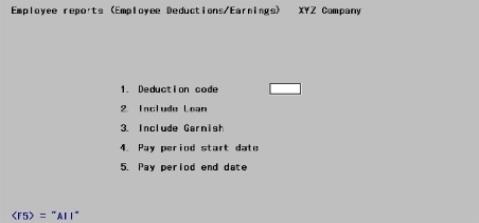

Character Mode

The following screen displays:

Enter the following information:

Options

Enter the deduction code. This must be on file in Deductions / earnings. You can also use the option:

|

<F5> |

For All deduction codes |

|

Format |

Three characters |

|

Example |

Press <F5> |

Check the box for yes (Enter Y) or unchecked for no (N).

|

Format |

Graphical: Checked is yes and unchecked is no. The default is unchecked Character: One letter, either Y or N |

|

Example |

Type Y to include loans |

Check the box for yes (enter Y) or leave it unchecked for no (N).

|

Format |

Graphical: Checked is yes and unchecked is no. The default is unchecked Character: One letter, either Y or N |

|

Example |

Type Y to include garnishments |

Pay period end date

Options

Enter the range of pay period ending dates to be included in the report, or use the option:

|

<F2> |

For the Earliest or Latest date |

|

Format |

MMDDYY at each field |

|

Example |

Enter a range of 10115 through 13115 |

Make any desired changes and then select OK or press <Enter> to print the report.

This report helps you to prepare a 941 Quarterly Report and a 941 Schedule B. The 941 form is the Employer's Quarterly Federal Tax Return.

The instructions for filling out the 941 form are available online from IRS: http://www.irs.gov.

In addition to printing the report, there is an option to export XML data that can be opened into a PDF form of the 941 and 941 Schedule B.

The address that prints on the report and gets generated in the PDF merge file comes from Payroll Control information. In the case of the PDF merge file address line 3 is NOT used because the form only allows for printing 2 address lines. So, you should put city, state and zip in address line 2. See the address fields in Control Information.

Some of the data for this report is being taken from Payroll files. Other data must be entered manually on the 941 Prep. report screen. Some of the 941 PDF fields are not included for entry. If needed you must enter this data manually on the PDF file fields.

As of July 2020, the 941 Prep report and matching 941 PDF form file have been altered for COVID-19 reporting. Be sure to install the latest hot fix or update to use this version of the report and PDF file.

The 941 screen entry and PDF output have changed from previous version, even if you do not have COVID-19 data to report.

There are new entry fields for COVID-19 reporting for qualified sick leave, qualified family leave and three others. You may enter these on the 941 screen.

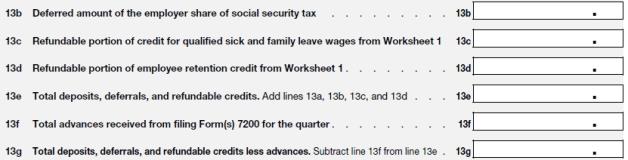

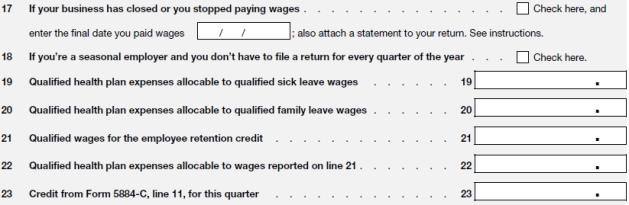

However, as of the second quarter 2020, 941 PDF fields 13b through 13g and fields 17 through 23 and field 25 are new fields and these amounts are not entered on the PBS 941 report screen and they are not calculated in the program. If you require data for any of these fields, you must enter it manually on the Form 941 PDF after the report XML data is generated. Be aware that entering data in these fields could affect totals and you will have to update totals as required.

Select

941 Prep. report from the Reports, General menu.

This report allows you to prepare a 941 Quarterly report and 941 Schedule B. The design of this report is to reference the input fields from the report creation screen to the fields in the report and the 941 form.

Enter the following information:

Which Quarter ?

Enter the quarter of the year on which you are reporting. The year is the same as entered in PR Control information.

Are wages, tips and other compensation subject

|

|

to social security or Medicare tax (line 4) |

Normally you should accept the default of Y. If you only have contract employees who never have Social Security or Medicare withheld, and do not have Federal income tax withheld then enter N.

After selecting Y, this question displays:

Do you have any COVID-19 related amounts to report for this quarter ?

Enter Y and the program displays a window for entering the COVID-19 related amounts. Enter N to skip to the Section 3121(q) Notice and Demand (line 5f) field.

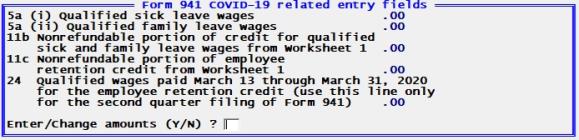

COVID-19 Related Entry Fields

After entering Y to the COVID-19 question above, the program displays the fields in this window:

These are the COVID-19 related fields that are provided for entry and are written to Form 941 report and PDF file. Enter Y to enter or change amounts in these fields.

5a (i) Qualified sick leave wages

If you used a Workers' comp COS code to track the sick leave amounts, run the History by Workers' WC Code report to get the amount for entering this field. See the Payroll History by WC Code Report report. Otherwise, if you have not used the COS Workers' Compensation code for tracking sick leave, you must manually accumulate the amount and enter it into this field.

|

Format |

Numeric, 9999999999.99 |

5a (ii) Qualified family leave wages

If you used a Workers' comp COL code to track the family leave amount, run the History by Workers' WC Code report to get the amount for entering this field. See the Payroll History by WC Code Report report. Otherwise, if you have not entered and used the COL Workers' Compensation code for tracking family leave wages, you must manually add the amount and enter it into this field.

|

Format |

Numeric, 9999999999.99 |

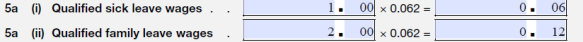

These are the 941 5a (i) and 5a (ii) fields on the 941 PDF after the XML data is generated:. The 0.062 calculation is produced by the PBS program when generating the data:

Note that the amounts from thesick leave and family leave fields are not included in the 5a. Taxable social security wages field total.

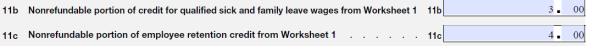

11b Nonrefundable portion of credit for qualified sick and family leave wages from Worksheet 1

Worksheet 1 is found on the Form 941 instructions. Enter the amount from line 2k that you entered on the worksheet. Note that, at the time of writing this, the Form 941 instructions are a draft. These instructions could change when the final version is released.

|

Format |

Numeric, 9999999999.99 |

11c Non refundable portion of employee retention credit from Worksheet 1

Worksheet 1 is found on the Form 941 instructions. Enter the amount from line 3j that you entered on the worksheet. Note that, at the time of writing this, the Form 941 instructions are a draft. These instructions could change when the final version is released.

|

Format |

Numeric, 9999999999.99 |

The 941 PDF 11b and 11c fields are the COVID-19 values after the XML data is generated:

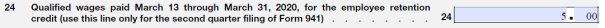

24 Qualified wages paid March 13 through March 31, 2020 for the employee retention credit (use this line only for the second quarter file of Form 941)

Enter the first quarter employee retention amount that is reported on the second quarter 2020 Form 941.

|

Format |

Numeric, 9999999999.99 |

This is line 24 on the 941 PDF file.

After entering the COVID-19 amounts, enter the N to Enter/Change amounts and to continue with the remaining fields on the screen.

Other 941 Entry Fields

These fields have not changed and may be entered as needed.

Section 3121(q) Notice and Demand (line 5f)

|

Note |

See the IRS 941 instructions for how to enter this field and other fields up to the Total deposits and prior qrtr ovrpayments field. |

Current qrtr fractions of cents adj. (line 7)

Current qrtr sick pay adj. (line 8)

Current qrtr tips and group term adj. (line 9)

Qualified small bus. tac credit (line11)

Total deposits and prior qrtr ovrpayments (line 13)

Enter Y to create a form that merges with a 941 PDF. It merges PDF data with an xml form of the 941 data. Not all data is merged into the PDF file. You must enter the remaining data in the PDF, as needed.

The location of the form is in the PDFFORMS folder located under the top-level PBS.

If you select N, the next two fields are skipped and you can only print the report.

Whether you select Y or N, you must print the report regardless.

|

Note |

Each year the 941 form changes, even if the only change is the year at the top of the form. The PDF form, provided by PSI, was originally provided by IRS. Check with IRS web site to verify that you have the latest version. Here is a location where the form may be found: http://www.irs.gov/uac/Forms,-Publications,-and-Other-Tax-Products If the form changes, the program printing this report will likely need to change as well. Look for an update from PBS. |

Name of PDF form to be merged

This field is skipped if you selected N to Create 941 PDF merged form ?

This is the name of the PDF file. It is recommended that you use the default of f941_2020_2_4.pdf.

Name of xpd to be created

This field is skipped if you selected N to Create 941 PDF merged form ?

This is the name of the xml file that contains the data to be merged into the PDF file.

You may use the default file name, which is f941_data_2020_2_data.

The file gets generated as the last step of printing this report. See Open the XDP Files and Edit

Filing Schedule B (Form 941) this quarter ?

Selecting Y for this field prints a second page with the 941 Schedule B information. This may be used if you are a Semiweekly Schedule Depositor. See the Form 941 Schedule B IRS instructions to see if this applies to you.

|

Note |

The data for Schedule B is printing from Payroll history. The data for the standard Form 941 report is from Quarter-to-date history. Due to rounding, the Quarter tax liability total on the Schedule B may not match line 10 on the Form 941. When this happens, this message displays on the screen: Form 941 Schedule B total liability for the quarter does not equal line 10 for Form 941. Also, near the bottom of Schedule B, you will see something like this printed: Form 941 Schedule B total liability for the quarter exceeds Form 941 line 10 by $0.02. The difference should be minor. To make them the same, you may enter the difference in Current qrtr fractions of cents adj. (line 7). See the IRS 941 instructions for entering this field. |

Create 941sb PDF merged form ?

Enter Y to create a form that merges with a 941 Schedule B PDF file. It allows you to merges PDF data with an xml form of the 941 Schedule B data. You may have to enter additional data in the PDF.

The location of the form is in the PDFFORMS folder located under the top-level PBS.

If you select N, the next two fields are skipped and you can only print the 941 Schedule B report.

Whether you select Y or N, you must print the report regardless.

Name of PDF form to be merged

This field is skipped if you selected N to Create 941sb PDF merged form ?.

This is the name of the PDF file. It is recommended that you use the default of f941sb.

Name of xpd to be created

This field is skipped if you selected N to Create 941sb PDF merged form ?.

This is the name of the xml file that contains the data to be merged into the PDF file.

You may use the default file name, which is f941sb_data. However, you may want to change the file name to reflect the company, year and quarter. You may enter up to 20 characters. Here is an example:

XYZCompany-2020-1sb

The file gets generated as the last step of printing this report1

Any change ?

Enter Y to make changes or press <Enter> to accept the default of N to continue.

The Company address comes from Payroll Control information.

The Printer selection screen will display. Choose to print the 941 Preparation Report to a Company information printer, Windows printer, Print to disk or Display on the screen.

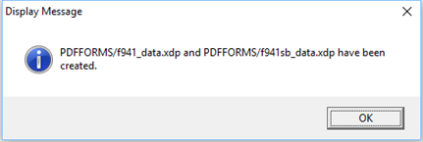

When the program finishes printing or displaying the report data, the f941.xdp file is generated. A message displays letting you know that the file or files have been created and the names of the files. Here is an example when both files are created:

PDFFORMS folder

In order to open either xdp file, you must first navigate to the PDFFORMS folder in the top-level PBS. The f941_data.xdp file and f941sb_data.xpd file are both located there. If you have a previous xdp file open from another quarter, close it before you open the new generated version. If you do not, you run the risk of merging data from 2 quarters.

Open either xdp file by double-clicking on it. Add data and edit data as needed. After editing the data, you may save the PDF file with a different name. It is recommended to enter a PDF file name to reflect the Name of the company, Year and Quarter . Here are two examples:

XYZCompany-2023-1.PDF

XYZCompany-2023-1sb.PDF

You should be using the latest version of Adobe Reader or Adobe Pro. Older versions may also work, but are not recommended as you could encounter error (older version) messages.

When opening the xdp data into the PDF form, the data may not display because of Acrobat security. Instead, this message displays: Data from this site is blocked to avoid potential security risks. Click Options to receive this data if you trust this document. If it does, select Options and select to Trust this document always.

On a Linux system, to open the file, copy or move it to a Windows workstation (with Acrobat installed).

|

Note |

Before you submit to IRS, you must verify that the data on the form is correct. You must enter any additional required data that is missing on the form. |

These 941 fields are not computed or entered on the 941 Prep. report screen. If needed you must enter these fields manually on the 941 and where needed, add those amounts into the totals:

This report is designed to help you in posting meals expenses to the general ledger. It shows meals expense, by employee, for either a selection of pay periods or for all pay periods. If meals and tips are not selected for use in Control information, skip this section.

Meal expenses may be taxable or not taxable, as specified in the meals type, earning code records. This report provides a concise summary of the meal expense amounts entered and posted for time transactions.

Depending on your company policy, meal expenses may or may not be reimbursed to each affected employee. If you do reimburse your employees for their meal expenses, you could use this report for this purpose by printing it after each run of payroll checks is posted.

Select

Meals expense from the Reports, Employee/Employer menu.

Graphical Mode

The following screen displays:

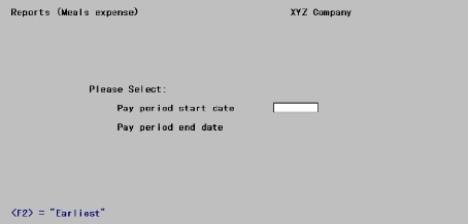

Character Mode

The following screen displays:

Enter the following information:

Pay period end date

Options

Enter the date range of pay periods for which the Meals Expense Report is to print, or use the option.

|

<F2> |

For the Earliest starting date or Latest ending date |

|

Format |

MMDDYY at each field |

|

Example |

Type 70415 as the starting date and 71815 as the ending date |

Make any desired changes and then select OK or press <Enter> to print the report.